At Horter, we stand by our client-centric, goals-based, risk-managed approach to investment management. We’ve spent decades developing a multitude of portfolio solutions. This helps us provide you with a range of options as we custom design your portfolio. We strive to prioritize your goals, managing the risks, and navigating through all stages of life and market fluctuations.

At Horter, “goal-based investing” is a key tenet of our investing belief system. We believe in a disciplined, portfolio design process to help ensure we have an investment portfolio that matches the client's goals, objectives, risk tolerance and time horizon.

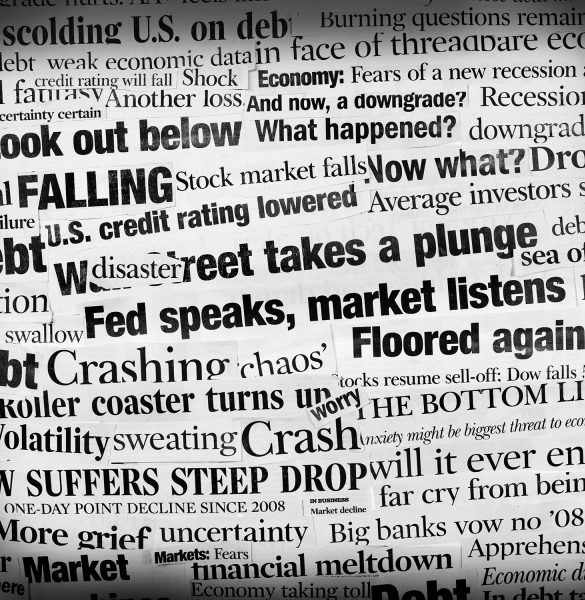

Ask yourself, if given a choice, do you really want to remain fully invested the next time the bears start to growl on Wall Street? Does it make sense to simply close your eyes and be forced to accept the full “rage” of the next nasty bear market cycle?

Our answer is a resounding NO. We believe that managing the risk associated with severely negative market cycles is an important part of what we call “modernized portfolio diversification.” In short, our goal is to lose the least amount possible during bear markets.

Free Portfolio Risk Analysis

At Horter, we focus on a high tech, real-time approach to designing and diversifying portfolios. Whenever possible, we employ risk mitigation techniques as well as multiple investing methodologies, strategies, and managers.

Horter’s investment committee brings together a wealth of portfolio manager expertise and experience. With more than 75 years of combined portfolio design and investment management experience, the team has managed money through good times and bad.

We understand everyone is different! We listen, engage, and work to create an investment plan that helps you meet your personal financial goals and objectives.

A diverse team of money managers monitor our investment models daily. We continually manage and review their performance. You will have full transparency into your accounts at all times, and we will assign a designated IAR Support Specialist to you personally.

We work with third party custodians: Schwab, AXOS, Nationwide, and TradePMR, with a few others under consideration. Your funds/assets are not in custody directly with Horter.

Our advisors want to work with any individual that has a goal of growing their assets and developing an overall comprehensive investment strategy. We don’t set minimums and are happy to discuss this with you.

The best way to see if we’re a good fit is to have a conversation. Call, email, or fill out the form below to speak with one of our team members. We’ll get in touch as soon as possible.